Cryptocurrency blog

Cryptocurrency blog

Rise of Cybercrime: Lost Money Is Irrecoverable

Why Is Lost Cryptocurrency Money Irrecoverable? The Unstoppable Rise of Cybercrime

In 2024, the FBI Internet Crime Complaint Center (IC3) reported a record surge in cybercrime, with an alarming $16.6 billion in losses—a 33% increase compared… Read more

How to Easily Exchange Dollars to Bolívares in the parallel market

To exchange Dollars to Bolívares in the parallel market has become an increasingly complex task due to Venezuela's strict currency controls and ongoing economic fluctuations. Traditional banking methods and government-regulated exchange pl… Read more

Stablecoins: The Quiet Revolution in the Cryptocurrency World

In recent years, cryptocurrencies like Bitcoin and Ethereum have seen tremendous volatility in their prices. This instability has hindered their adoption for regular transactions and payments. Enter stablecoins - a new form of cryptocurrency designed… Read more

The Importance of Exchanges in the Crypto Ecosystem

In a dynamic and ever-evolving market, these platforms not only facilitate the exchange of assets like Bitcoin and Ethereum but also reflect the maturity of an industry that has transitioned from an experiment to a global force. We explore their sign… Read more

Thrills and Spills of Loyalty: Casinos vs. Sportsbooks in 2025

The world of gaming entertainment will grow ever more competitive by the year 2025. With more casinos, online betting sites, lottery games and other gambling options available than ever before, gaming providers work harder to attract and retain custo… Read more

Blockchain.com Faces FBI Complaint Filed by Caporaso & Partners

Table of Contents

Unregulated Actions and Abusive Practices by Blockchain.com

A Legal Void Fostering Impunity

Call for Immediate Action against Blockchain.com

Challenges and Legal Complexities in Disputes Across Multiple Jurisdictions… Read more

Higher Taxes on Cryptocurrencies in 2025: Implications and Global Trends

The increasing tax regulation on cryptocurrencies, particularly high taxes on gains, has gained traction worldwide. Recently, Italy announced a drastic measure to raise the tax rate on digital assets from 26% to 42% starting in 2025, a move that has … Read more

The Bitcoin Swing

Bitcoin will experience a sharp fall sooner rather than later, and the market is feeling the pressure, but it's advisable to wait

In a period of growing uncertainty in the world of cryptocurrencies, Bitcoin faces a potential significant reduct… Read more

OneIndex.net is your gateway to the crypto market

Through a model of periodic rebalancing, the composition of the index is regularly adjusted to align with the current market trends, thus maximizing the potential returns for investors.

Moreover, OneIndex.net introduces a unique revenue-sharing ap… Read more

Why is Bitcoin Rising?

A Deep Analysis The landscape of cryptocurrencies, particularly Bitcoin, is at a crucial point of definition

As of December 2023, Bitcoin has experienced impressive growth, increasing by more than 150% just this year. As we approach January 2024, … Read more

AllUnity, Deutsche Bank's Bet

Discover AllUnity, Deutsche Bank's Stablecoin aiming to Transform Finance and the Crypto Market

In the traditional financial system, the consolidation of stablecoins is becoming increasingly evident, and AllUnity could revolutionize the crypto… Read more

Telegram Wallet Blocks Cuban Users' Cryptos

In a surprising and unannounced decision, Telegram Wallet has chosen to block Cuban users' access to its platform. This unexpected action has raised concern and discontent among affected users, as it has led to the freezing of funds they had depo… Read more

Brazil Launches DREX Amid Criticism and Fear

The DREX will make its debut on December 4 and is expected to be operational at the beginning of 2024. The monetary authority of Brazil has reported a significant increase in cryptocurrency imports in the country, with a 44.2% rise in the first eight… Read more

Token AAL in the liquidity pool of PancakeSwap

The Antarctic (AAL) token is now available for trading on the decentralized exchange PancakeSwap. You can swap it in a liquidity pool specifically set up for the AAL/USDT pair.

What is the AAL token and why is it so attractive?

The Antarctic (A… Read more

Capitalix, a trustworthy broker for investing in different financial markets

Choosing a reliable broker is a crucial decision for any trader. Among the wide variety of options available in the market, Capitalix stands out, a company that offers customized solutions to help traders gain the necessary confidence to start invest… Read more

Why Crypto Is the Preferred Currency for Online Gamers

Cryptocurrencies have a relatively short but fascinating history. Bitcoin, the world's first decentralized cryptocurrency, appeared on the scene in 2009, designed to function as a digital currency form that operates independently of traditional f… Read more

Big brands who are making big moves in the US iGaming industry

The United States iGaming market is increasingly becoming one of the most interesting industries, with the introduction of regulations and favorable conditions starting to be experienced across the country, the nation has now become one that is start… Read more

How to File Crypto Taxes in Spain

Cryptocurrencies have become increasingly popular in Spain in recent years, and as such, the Spanish government has implemented laws and regulations regarding the taxation of bitcoin and cryptocurrency transactions. Investors need to understand how t… Read more

10 facts about bitcoin you probably didn't know

10 facts about Bitcoin you probably didn't know. Fourteen years ago, Satoshi Nakamoto mined the first block of the most famous cryptocurrency, Bitcoin.

In doing so, he officially gave birth not only to a cryptocurrency, but also to a con… Read more

How to set up Metamask with EthereumPoW network

The question of how to configure Metamask with the Ethereum Pow network arises after the appearance of Ethereum Pow. Metamask is one of the digital wallets and browser extensions compatible with EthereumPoW, the network that emerged after the Ethereu… Read more

What will change in The merge of Ethereum after the integration of 1.0 and 2.0 will after The Merge?

The merge of Ethereum after the integration of 1.0 and 2.0 will happen soon in an event known as "The Merge"

This major change to Ethereum after the merge will make it virtually impossible to mine Ether (ETH). What other transformations … Read more

Antarctic Foundation Set To Launch The Antarctic AAL Token

The team behind The Antarctic Token (AAL), an ALO Global project, is taking their pursuit of using crypto and blockchain as a tool of environmental protection a notch higher with the plans to launch the AAL token. According to the Antarctic (AAL) Fou… Read more

Antarctic (AAL) Token launch raises expectations

The Antarctic (AAL) Token launch, sponsored by the Antarctic (AAL) Foundation and using the Binance Smart Chain (BSC) blockchain, is about to begin. The launch date is Sept. 15 with the Airdrop.

The Antarctic Token is promoted by the Antarctic Lan… Read more

Euro-dollar parity favors Bitcoin and other cryptocurrencies

The news of euro-dollar parity favors Bitcoin and has roiled the markets. Many fear an economic recession in Europe. However, the sharp drop in the European currency is good news for cryptocurrencies, especially Bitcoin.

The 1:1 parity between the… Read more

Learn about the plunge of the Bitcoin crash

The Bitcoin plunge has dragged down the vast majority of cryptocurrencies. Why has this happened?

Is Bitcoin's plunge just a temporary decline? Here we explain three causes behind the collapse of the world's most widely used cryptocurrency… Read more

Best SHIB Wallet App to Use for Beginners: Trustee Wallet

When you read about cryptocurrency online or hear someone buy it, what do you feel? For many not-yet-into-the-crypto, the sphere seems way too hard to reach. But is it really so? Doesn’t the 21st century hold easy access to crypto coins and NFT… Read more

Why did the stablecoin Terra USD collapse?

The resounding fall of the stablecoin Terra USD (UST) and the LUNA governance token have sparked an uproar in the cryptocurrency market. Only one week ago, it was one of the top 10 coins in the world in terms of market capitalization. Within seven da… Read more

Cuba approves regulations to authorize cryptocurrencies

The Caribbean country of Cuba approves regulations to authorize cryptocurrencies. In less than a year, the Central Bank approved two documents related to crypto assets. The first one set Havana's official position on cryptos. The second detailed … Read more

Top news of the cryptocurrency market in Latin America

The acceptance of cryptocurrencies in Latin America continues to grow, see the top news of the cryptocurrency market in Latin America

In the last few days, the top news of the cryptocurrency market in Latin America could give a boost to the … Read more

Best Crypto Exchange Platform? Switchere Has the Answer!

If you are looking for the best place to sell and buy crypto with card, Switchere is your go-to website listing

This is a decentralized exchange that allows users to trade various coins. It was created with the goal of making cryptocurrency tradin… Read more

How to Earn Money With NFT

The chase for digital goods, otherwise known as NFTs, is real. NFTs rose to biggest fame at a lightning speed and are still continuing to occupy larger areas in different kinds of art. Images, GIFs, videos, Tweets, music pieces, albums, and in-game p… Read more

5 best platforms to market NFT

Nowadays, anything can become a token, find out the 5 best platforms to market NFTs. Where to buy and sell NFTs? These five platforms are currently offering the most facilities.

According to cryptocurrency tracker, DappRadaer, sales of NFTs genera… Read more

Bitcoin in Australia, the country seeking to become a cryptocurrency hub

Bitcoin in Australia has been gaining momentum after the country recognized cryptocurrencies as assets

Cryptocurrencies and Bitcoin have legal status in Australia and are treated as assets. Moreover, the country aspires to become a cryptocurrency … Read more

How to earn Ethereum as a decentralized arbitration juror

Learn how you can make money in Ethereum by serving as a juror in decentralized arbitrations with Kleros

Earning Ethereum is possible with a new blockchain opportunity. The company Kleros has created a protocol by which people who act as jurors … Read more

Lugano, the Swiss city that will adopt Bitcoin and Tether as legal tendency currencies

A Swiss city will begin to accept Bitcoin and Tether as legal tender currencies. How will this experiment end up?

The Swiss city of Lugano will adopt Bitcoin, Tether, and the LVGA token as “de facto” legal tender currencies. The mayor … Read more

What is a DAO and how can you create one?

DAO are English initials of the Decentralized Autonomous Organization. This is a new type of association, through the blockchain technology and with the use of smart contracts. There are no hierarchies, but DAO is controlled by computational algorith… Read more

Cryptocurrencies could save Russia from Western sanctions

Cryptocurrencies could save Russia and they could be the only hope for the Russian government, faced with Western sanctions. Why? We’ll explain it here

The United States and the European Union have imposed heavy sanctions on Russia. With thi… Read more

The US Moves to Regulate Cryptocurrency

With the rising popularity of Cryptocurrencies, the United States has moved to regulate digital currencies. However, it is not just the US government doing this; other governments worldwide are also formulating strategies to manage this new sector. C… Read more

5 cryptocurrencies worth investing in, in 2022

Experts believe that these 5 cryptocurrencies have a big upside potential, which makes them attractive to invest in, in 2022

The alternative cryptocurrencies (altcoins) are among the cryptocurrencies invest in, in 2022. According to the expe… Read more

Fear and greed index, a compass for cryptocurrency investors

Cryptocurrency investors are debating between fear and greed, facing the worrisome lowering tendency in the majority of the cryptocurrencies.

The “fear and greed index”, works as a compass for investors in the cryptocurrency market. If… Read more

Bitcoin ATMs in Panama will increase in number during 2022

In 2022,there will be more than 50 Bitcoin ATMs in Panama. This will turn the country into one of the region’s leaders in the number of cryptocurrency ATMs.

The business Santo Pay will install a total of 50 Bitcoin ATMs in … Read more

Portugal, a shelter for cryptocurrencies

Why is Portugal considered a shelter for cryptocurrencies and one of the most interesting for crypto businessmen? We’ll tell you in this article

Portugal is considered one of the friendliest countries for cryptocurrency businessmen. The prev… Read more

Mortgage loan in Bitcoin

A business based in Miami launched the first mortgage lending in Bitcoin program in the world. Will the initiative be successful?

The business Milo, headquartered in Miami, presented its program “Crypto Mortgage”. Through this initiati… Read more

Where is it better to invest, in cryptocurrencies and NFT or in Stocks?

In this article, we’ll share some explanations that can help you understand whether it’s better to invest in stocks or in cryptocurrencies and NFT.

If I have money saved up and I want to invest during 2022, where is it best to do it? I… Read more

How to create and sell NFT for free

It’s now possible to create NFT for free, without paying the fee for gas demanded by the Ethereum blockchain. We’ll explain here two ways to achieve this.

Non-fungible tokens (NFT) have become the best way for artists, from any part of… Read more

China and El Salvador, two paths separated over Bitcoin; which will win?

The Chinese and El Salvadoran governments have followed opposing paths in relation to cryptocurrencies. The second major economy of the world opted to ban cryptocurrencies; meanwhile, the small, impoverished Central American country adopted Bit… Read more

The 5 most common cryptocurrency scams and how to protect yourself from them

What are the 5 most usual cryptocurrency scams these days? We’ll tell you here; we’ll also share advice on how to avoid them, as well.

Cryptocurrency scams increased significantly during 2021. For this year, experts state that th… Read more

Puerto Rico, the trending destination for cryptocurrency investors

Puerto Rico has become one of the most looked for destinations for cryptocurrency businesses from the United States. Why has this happened? We’ll explain why, here.

Puerto Rico is an island that has had very little luck in recent times. The … Read more

Learn the advantages of Tether, the most renowned stable cryptocurrency in the world

Discover the advantages offered by Tether. Tether was the first stable cryptocurrency and these days it’s the one with the highest volume of negotiation and liquidity. Learn all of its features, here

Cryptocurrencies still don’t … Read more

How to mine cryptocurrencies from home

Is it possible to mine cryptocurrencies from home? Yes, but is this process profitable? We’ll deal with answering that question in this article

Mining cryptocurrencies from home is an attractive idea for people all over the world. However, c… Read more

Is mining for cryptocurrencies with Norton antivirus profitable?

With Norton Crypto, users can now mine cryptocurrencies with Norton Ethereum antivirus from their computers. Is it profitable?

Now you can mine cryptocurrencies with antivirus from your computer. This is done by means of Norton Crypto, a tool a to… Read more

Can I obtain Salvadoran citizenship when investing in Bitcoin?

The well-known economists Max Keiser and Stacy Herbert obtained Salvadoran residence when they invested in the country in Bitcoin.

This news has been the tendency in sites specialized in cryptocurrencies seeing that many are aspiring to Salvadoran… Read more

Number of Bitcoin ATMs in Panama will increase in 2022

In 2022, there will be more than 50 Bitcoin ATMs in Panama. This will make the country one of the leaders in the total amount of cryptocurrency ATMs for that region.

The business Santo Pay will install a total of 50 Bitcoin ATMs … Read more

‘Parabolically’*, Bitcoin can reach 333,000 USD

Bitcoin (BTC) could peak at the enormous amount of 333,000 USD by May of 2022. This is if the federal Reserve of the United States shares a “perfect storm” of low rates, a new prediction discusses.

When updating a prediction of incredi… Read more

Law 624: what changes for offshore Companies?

After Law 624 of 2021 goes into effect, offshore companies, real estate holdings, and inactive companies registered in Panama that have cryptocurrencies will have to keep accounting records. The Resident Agent will take guard this accounting and will… Read more

NFT prices sky high. Why do people pay so much money for an NFT?

The NFT market and prices continue to grow. Why do people pay so much money for an NFT? Can you create an NFT yourself and sell it?

The nonfunctional tokens (NFT) aren’t just one of the words of the year, but also a formidable business. Just… Read more

Diamond Cash, (DCASH), is already used in seven countries

Diamond Cash is a digital currency issued by the Caribbean Central Bank that is already used in seven countries. What advantages does this cryptocurrency offer?

The cryptocurrency Diamond Cash (DCASH), safeguarded by the Caribbean Central Ba… Read more

Woonkly, the social network in NFT

Woonkly is the social network where each post, photo, idea, book or business plan can be converted into NFT. Learn how to use it

Woonkly is the world’s first NFT metasocial network. In it, each post is automatically converted into an NFT. Ho… Read more

IRS will demand Report of cryptocurrency transactions greater than 10,000 dollars

Beginning January 2024, the IRS will demand a report of cryptocurrency transactions higher than 10,000 dollars. Why have they made this new law and how can they you comply?

The American IRS will require both natural and legal persons to declare an… Read more

The 5 best cryptocurrencies to invest in during December 2021

Which are The 5 best cryptocurrencies to invest in during December 2021? We’ll tell you here which are going to go up

The cryptocurrencies market has to recover in December and these are the 5 best cryptocurrencies to invest in. Bitcoin reac… Read more

Soccer player Andres Iniesta is in trouble because of cryptocurrency campaign

The soccer player Andres Iniesta is in trouble for participating in a publicity campaign for Binance. Do you think it was okay to lend his image in favor of cryptocurrencies?

The Spanish soccer player Andres Iniesta is in trouble because of being … Read more

Wright vs. Kleiman, the procedure for 66 billion dollars in Bitcoin

Wright vs. Kleiman is the trial in Miami where Ira Kleiman and Craig Wright confront each other, which is going to be the biggest legal dispute in history over Bitcoin. The winner will awarded with the astonishing amount of 1.1 million Bitcoins… Read more

Cryptocurrencies Video News - October 2021

Bitcoin can now be legally used for payments in Cuba

Resolution 215/2021 of the Central Bank of Cuba, which recognizes bitcoin (BTC) payments and other cryptocurrencies, has come into force this September 5. This after being publis… Read more

The future of Bitcoin according to one of its developers

Gavin Andresen is considered to be one of the first developers of the cryptocurrency and sees Bitcoin’s future thusly.

The programmer exchanged correspondence with Satoshi Nakamoto, the mysterious creator of this cryptocurrency and is,… Read more

What is MetaMask and how is this wallet formatted?

If you’ve wondered what MetaMask is, the answer is the most secure digital wallet that is installed as an extension of your web browser.

The answer to “What is MetaMask” is simple: the most secure digital wallet that also permits… Read more

What will happen with cryptocurrencies, faced with their ban in China?

What is the future of cryptocurrencies faced with their ban in China? Any type of transaction with cryptocurrencies was banned

The market is wondering about the future of cryptocurrencies, faced with their ban in China. China’s Communi… Read more

From whales teeth to Bitcoin: a brief history of money

Money is an object that has no intrinsic value; however, at present, that scrap of paper, metal coin or cryptocurrency is indispensable in contemporary living.

How did this happen? The answer is in the centuries’ old history of money. … Read more

PoolTogether, the lottery where you never lose

PoolTogether, the lottery where you never lose, has become a sensation. It seems like a scam, but it’s been working well for some time.

Invest a dollar and you can win thousands, this is PoolTogether, the lottery where you never lose. It… Read more

Cryptocurrencies Video News - September 2021

Table of Contents

The U.S. SEC sends alert against cryptocurrency investment scams

Sweden owes $1.35 million to drug dealers for selling Bitcoins

Dogecoin 2.0 cryptocurrency value skyrockets more than 450% in… Read more

What Are NFT Drops?

The world of crypto is changing all the time. We’re not just talking about new cryptocurrency tokens, but new technologies that push that specific market forward into a new era. NFTs are one of those things that have taken the crypto market a s… Read more

During the coronavirus, are cryptocurrencies suffering or taking advantage of the moment?

Up until just a short time ago cryptocurrencies were considered to be a sort of safe haven. This idea has gained greater strength in the measure in which, during recent periods of crisis and instability, the Bitcoin has risen in value; however, now, … Read more

How to create an ICO?

Table of Contents

What is an ICO token?

Advantages of an ICO

Differences between an ICO and an IPO

What does an ICO have to contain?

Principal regulations for the ICOs

How to identify swindles in an ICO

An ICO is an Initial… Read more

Cryptocurrencies Regulations in The Caribbean

Table of Contents

Anguilla

Antigua and Barbuda

Bahamas

Barbados

British Virgin Islands

Cayman Islands

Dominica

Dominican Republic

Grenada

Jamaica

Montserrat

Saint Kitts and Nevis

Saint Lucia

Saint Vincent a… Read more

Cryptocurrencies Regulations in the Americas

Table of Contents

Argentina

Belize

Bermuda

Bolivia

Brazil

Canada

Chile

Colombia

Costa Rica

Ecuador

El Salvador

Guatemala

Honduras

Mexico

Venezuela

Argentina

Under the National Constitution of A… Read more

Cryptocurrencies Regulations in Sub-Saharan Africa

Table of Contents

Ghana

Kenya

Lesotho

Mozambique

Namibia

South Africa

Swaziland

Uganda

Zambia

Zimbabwe

Ghana

In January 2018, the Bank of Ghana issued a brief notice to banks and the general public advising a… Read more

Cryptocurrencies Regulations in South Asia

Table of Contents

Bangladesh

India

Nepal

Pakistan

Bangladesh

On December 24, 2017, the Central Bank of Bangladesh issued a cautionary notice that cryptocurrencies are illegal in Bangladesh. According to a news report, the noti… Read more

Cryptocurrencies Regulations in Non-EU Members

Table of Contents

Albania

Armenia

Azerbaijan

Belarus

Bosnia and Herzegovina

Georgia

Gibraltar

Guernsey

Iceland

Isle of Man

Jersey

Kosovo

Liechtenstein

Macedonia

Moldova

Montenegro

Norway

Russia

… Read more

Cryptocurrencies Regulations in Middle East and North Africa

Table of Contents

Algeria

Bahrain

Egypt

Iran

Iraq

Israel

Jordan

Kuwait

Lebanon

Morocco

Oman

Qatar

Saudi Arabia

United Arab Emirates

Algeria

The 2018 Financial Law of Algeria has prohibited the use… Read more

Cryptocurrencies Regulations in EU Member States

Table of Contents

Austria

Belgium

Bulgaria

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Latvia

Lithuania

Luxembourg

Malta

Netherlands

… Read more

Cryptocurrencies Regulations in East Asia and the Pacific

Table of Contents

Australia

Brunei

China

Cambodia

Hong Kong

Indonesia

Japan

Macau

Malaysia

Marshall Islands

New Zealand

Philippines

Samoa

Singapore

South Korea

Taiwan

Thailand

Vanuatu

Vietnam… Read more

Cryptocurrencies Regulations in Central Asia

Table of Contents

Kazakhstan

Uzbekistan

Kyrgyzstan

Tajikistan

Kazakhstan

On March 30, 2018, the head of the Kazakhstan National Bank, Daniyar Akishev, stated that the National Bank had a very conservative position on the i… Read more

World’s First Global Public Register For Cryptocurrencies

Cryptocurrencies Public Register is the only global Register for cryptocurrencies, tokens, ICO, IEO and STO

Do it in 3 Simple steps

1. Apply for an account | 2. Pay | 3. Get your registration and optional a Certificate

To… Read more

The Indian Supreme Court eliminates veto against transactions made with cryptocurrencies

The Indian Supreme Court allowed banks of this country to manage cryptocurrency transactions originating from exchange bureaus and, this way, annulled the veto that the Reserve Bank of India had imposed.

The veto had been in force since April of 2… Read more

Tokenizing real estate, the future of the real estate market

Tokenizing real estate is done through a “smart contract”, and with it a value is given to a token, in correspondence to the asset or to a part of it. According to Eric Sanchez, CEO of the business RentalT, this method is the real estate … Read more

Bitcoin is getting ready to accelerate with Lightning Network

Lightning Network, Bitcoin’s second network, is already in operation.

The Lightning Network is a protocol that allows Bitcoin’s transactions to accelerate to the max.

It’s said that it can process a million transactions per se… Read more

How to recover your reputation, both business and personal

Recovering your online reputation in the cryptocurrency world, damaged by customers, competitors, legal or financial problems, is possible

Losing your online reputation in the cryptocurrency world is fairly common. Developing a strategically focus… Read more

Are capital gains taxes paid on Bitcoin?

Are capital gains taxes paid on Bitcoin?

“Do I really have to pay taxes for capital gains from Bitcoin and other cryptocurrencies?”

Lately, I’ve been hearing this question a lot.

What happened? The cryptocurrency prices, ha… Read more

Ripple, the cryptocurrency that fell into disgrace

In the middle of the cryptocurrency boom, with Bitcoin breaking daily records in its quotations, one of the most popular and best valued cryptoassets on the market, Ripple (XRP), has fallen into disgrace. The Securities and Exchange Commission … Read more

The Lemon Tech e-wallet operates with money and cryptocurrencies

The Lemon Tech e-wallet operates with money and cryptocurrencies and is expanding in Latin America and Europe

Not long ago the Lemon Tech e-wallet reached the number of 10,000 users, with a network of around 1,000 sops on its platform. They recent… Read more

The investors give in and consider bitcoin to be a safe bet

The coronavirus pandemic has brought world to an unimaginable economic recession, but for investors and neophytes, the Bitcoin is a safe bet. While the majority of traditional currencies are tottering, the best known and most used cryptocurrency thes… Read more

Jack Ma, the founder of Alibaba, is hoping for cryptocurrencies

The richest man in China, the multimillionaire Jack Ma, founder of the Alibaba consortium, harshly criticised the financial regulations and the manner in which the international banking system works these days.

According to Ma, the prevailing obst… Read more

Celebrities who back cryptocurrency

When cryptocurrency first came out, it was such an alien subject, and it scared most people. But others weren’t deterred by this, and some people invested heavily in this because they knew it had potential or believed so anyway.

Throughout t… Read more

Which Casinos Accept Crypto as a Payment Method?

Are you looking to find nothing but the best crypto casinos for you to play at? Look no further than here. Put together by a team of seasoned online gamblers; this crypto casino list has all you are looking for.

From exciting signup bonuses to exc… Read more

The History of Dogecoin and Gambling

Dogecoin, named popular internet meme ‘Doge’, had proven to empower online communities by taking hold of the life of its own when it was meant as a jest by its creator. In fact, Dogecoin was first used as a way to ‘tip’ conten… Read more

PayPal and MasterCard open up to cryptocurrencies

Years ago, the MasterCard CEO, Ajay Banga, said that “currencies not controlled by a government were trash.” Now, his company has reconsidered this position and European users will be able to use, from anywhere in the world, MasterCard ca… Read more

Car rental in Cuba, the best options

Car rental in Cuba can seem to be easy; however, it’s actually extremely difficult, for various reasons, even though one stands out above the rest: the low availability of automobiles that Havanautos, Via Rent a Car, Rex and Cubacar – the… Read more

Cryptocurrencies will have a global public register

The number of cryptocurrencies being used in the world is enormous; however, up to now, there is no platform that joins them together and eases their identification. This lack is the reason for the Cryptocurrencies Public Register Institute, an NGO i… Read more

Israel’s Attorney General orders banks to offer services to businesses related to cryptocurrencies

Israel’s Attorney General, Avichai Mandelblit, ordered the banks of his country to offer services to businesses related to cryptocurrencies. These declarations were produced in a context where the Israeli Central Bank demanded that the fi… Read more

Stablecoins will try to be strengthened in 2020

Stablecoins will deal with strengthening themselves in 2020, in a context where many feel that price stability that they offer will convert it into a better option than other cryptocurrencies. The stablecoins, like many other cryptocurrencies, … Read more

Should your company accept payment in cryptocurrencies?

More and more people around the world are becoming familiar with cryptocurrencies. Although in the beginning the majority knew only Bitcoin, which became the most circulated cryptocurrency on a global level, it’s certain that these days more th… Read more

The story of the guru who could have been a millionaire with Bitcoins

Antonio Andres Henche was one of the first people to begin mining Bitcoins, when the cryptocurrency was more or less unknown and its value negligible. This 42-year old informatic engineer recognized that, in this period, he could mine four or five Bi… Read more

Advantages and polemics around Libra, the Facebook cryptocurrency

Table of Contents

Facebook Planet

What is the Libra cryptocurrency?

Libra Association, one of the centers of polemics

Libra vs. Bitcoin

Fears regarding Libra

The path of the Libra Association is becoming complicated. Under the… Read more

The best bitcoin casinos

Cryptocurrencies are taking on more and more importance in the world of online gambling. These days, the best bitcoin casinos offer an ample series of options that are very attractive. The players use the decentralization and anonymity that char… Read more

The European Union approves anti money laundering Directive for cryptocurrencies

The European Union (EU) approved the fifth Anti Money Laundering Directive (Directive 2018/843 of the European Union, aka 5AMLD), where the fifth Anti Money Laundering Directive organization’s member states are asked to include in their legisla… Read more

Is cryptocurrency mining a profitable business?

Table of Contents

What is cryptocurrency mining?

How does cryptocurrency mining work?

How many ways of mining are there?

What equipment is necessary for cryptocurrency mining?

Which are the most profitable cryptocurrencies for mining?… Read more

Why was Bitcoin SV banned from the Binance Exchange?

Bitcoin Satoshi Vision (Bitcoin SV) was banned by various exchanges, among them Binance, Shapeshift and Blockchain.com, because of a “lack of ethics” continues to generate controversary in the cryptocurrency community.

Bitcoin SV hasn… Read more

Bitcoin regained value and forecasts puts its price at 55000 USD by 2020

At the end of 2017, Bitcoins prices reached their highest price, almost 20 000 USD. Then a fall whereof (drastic fall) which at the end of 2018 placed the BTC value at just over 3 000 USD; However, in 2019, a recovery of 25% placing this Cryptocurren… Read more

The 10 biggest Cryptocurrency investors

The popularity and Cryptocurrencies values are undeniable today. Far from the initial skepticism of 2009, when Satoshi Nakamoto published the historic "white paper" with which he presented the Bitcoin. This and other Cryptocurrencies have g… Read more

Buy and sell cryptocurrencies

Buy and sell locally Bitcoin, Ethereum and Tether, find out how easy is to buy and sell locally Bitcoin, Ethereum and Tether in www.cryptocurrency10.com. Bitcoin is the most used cryptocurrency, Ethereum is the second and Tether is the most esta… Read more

How to avoid scams in LocalBitcoins

By Mary Purpari

Due to limits placed by international banking on trading with Cryptocurrencies, in addition to a lower volume of trade on exchanges, people are trading more and more on Peer-to-Peer exchanges. LocalBitcoins is one of the most popul… Read more

Which Exchange can we use?

One of the recurring difficulties of Cryptocurrencies is the need to use multiple exchanges. How do we choose them and what are the differences between them? Let's be clear here!

Some exchanges allow the use of fiat currency (EUR, USD, GBP, etc.… Read more

What are stable Cryptocurrencies?

Cryptocurrencies have developed throughout the world because of their multiple benefits, including the low transaction costs and decentralization; However, its volatility continues to arouse many doubts among investors, given the very real risk that … Read more

Is the Overseas Money Transfer Industry Experiencing a Blockchain Effect?

The international remittance market has witnessed significant changes over the last couple of decades, mainly because of the arrival of several FinTech companies. Now, it appears that blockchain is also making inroads in this seemingly lucrative real… Read more

Anonymous miners dominate Bitcoin block processing

The growing number of anonymous miners who process blocks in the Bitcoin Network (BTC) has attracted the attention of several experts, because this is a new trend, since long ago, most of the miners’ groups revealed their identity through a Coi… Read more

How can we fight against embargo on bank accounts and securities?

Today, the possibility of a quick return to poverty is quite real. With the end of banking secrecy under the supposed idea of combating terrorism, drug and arms trafficking most especially mafias and criminal organizations, we have seen that in many … Read more

YouHodler to obtain a loan

YouHodler, a platform to obtain loans with Cryptocurrencies as collateralYouHodler is a Cryptocurrency loan platform that has presented an interesting online tool, whereby people can obtain loans in Altcoins, US dollars and Euros with low interest ra… Read more

Bitcoin back to the bottom

Bitcoin, the most widely used Cryptocurrency in the world, has undergone five price corrections throughout its first decade of existence. The latest modification confirms a worrisome downward trend, as according to a report by analyst and investor Pe… Read more

Saudi Arabia will present its own Cryptocurrency

Saudi Arabia is to present its own Cryptocurrency in 2019, with a name not yet unveiled, in order to ensure that the new Cryptocurrency operates in the interbank payment service, even at international level. The confirmation of the Saudi Cryptocurren… Read more

The first ETP based on a cryptocurrency basket will be on the Zurich Stock Exchange

As reported on November 16th by Financial Times (FT), the Zurich Stock Exchange (SIX) will quote/announce by next week, the first exchange-traded product (ETP) in the world based on multiple cryptocurrencies.Supported by the Swiss company Amun AG, th… Read more

Bitcoin Cash collapses due to the Fork

On November 15th, the Bitcoin Cash bifurcation occurred and, a few days after the event, we can say that this fork has not only affected the entire cryptocurrency sector, but has affected the Bitcoin cash itself (that we remember, isn't Bitcoin, but … Read more

10 years of Bitcoin existence and the main stages of the most important Cryptocurrency

To some, it may be much, but few to others, it’s already a decade since the Bitcoin whitepaper written by Satoshi Nakamoto was launched. In this article, we will like to go back to the main stages in the history of the King of Cryptocurrencies,… Read more

What is Bitshares (BTS)?

This week, we will be discussing a token that has been catalogued as one of the top ten Blockchain projects by the China Center for Information and Development (CCID).BitShares is a Cryptocurrency created in the middle of 2014.It is also an efficient… Read more

What are the safest exchanges?

Group-IB, a major company operating in the field of cybersecurity just recently classified the security level of major Cryptocurrencies exchanges.From the data collected by the company in collaboration with the CryptoIns insurance platform, Kraken wo… Read more

what is NULS?

It is a rapidly rising token in CoinMarket CAP ratings and has been included in the top ten Blockchain projects by the China Center for Information and Development (CCID). This Singapore-based project is trying to develop a highly adaptable Blockchai… Read more

Bitcoin Cash hard fork arrives

The bifurcation is scheduled for November 15th and, therefore, preparation by the organizations that supports this Cryptocurrency has already begun.BCH routinely performs a hard fork every six months. The bifurcation of November 15th is a bit differe… Read more

How can we handle the next Bitcoin halving?

On May 21, 2020 there will be the next Bitcoin halving, like every 4 years. World production will fall from 12.5 to 6.75 Bitcoins per block, halving. Fundamental economic laws states that, with the same demand, if supply decreases, price will increas… Read more

China drops back Bitcoin in the best Cryptocurrencies ranking

In August, Bitcoin was ranked tenth in the classification of the China Center for Information and Development (CCID). Now, when updating the ranking from the analysis of 33 public Blockchain projects, Bitcoin has fallen to 19th position, while EOS an… Read more

What is X-infinity (XIF)?

X-Infinity has developed a wallet where it is possible to store more Cryptocurrencies in a safe way. This wallet is also connected to a custom debit card, which can be used in any vendor who accepts debit cards and also permits cash withdrawals at in… Read more

What is ETHLend (LEND)?

It is a token linked to a lending platform, i.e. a loan platform. This is a well-structured project, but above all we dare to say revolutionary. The basic idea is to take advantage of BLockchain and Cryptocurrencies to create a micro-credit platform.… Read more

Litecoin vs Bitcoin

In recent weeks, the world of Cryptourrency has focused on the issue of the Bitcoin ETF, a theme that, with BAKKT’s introduction, has been further driven since its platform is much like that of this family of financial instruments.

However, if… Read more

The 25 most prominent cryptocurrencies

In 2018, a lot of people have heard of cryptocurrencies. But not many really do know what they are or what types there are.

Well, cryptocurrencies are a type of digital, decentralized currencies which use advanced programming and cryptography as a f… Read more

Cryptocurrency mining to finance politics

This idea is from the United States, where a company has sent an application to the Federal Election Commission to request the approval of a new method of financing electoral campaigns.

Practically, it operates like this:

1. On the party website … Read more

Ethereum Trend

ETH (USD 204), like all the other cryptocurrency sectors, in the last week, recorded a considerable but brief increase between Sunday and Monday, however, the values later returned to the previous levels. However, it is still difficult to say whether… Read more

What are decentralized exchanges?

You must have surely tried once to register on a Cryptocurrency Exchange site, for example, to buy Bitcoins or other digital currencies. If you've done it, you may have noticed that it's not a joke...Also, if you have had some experience moving large… Read more

What is an ICO?

ICO is the acronym of Initial Coin Offer whose purpose is to raise money to finance a project that provides, among other objectives, issuing a token or currency.ICO has reached a new method of fundraising, outside the traditional channels and institu… Read more

Weekly Report

Each week, our trading experts makes careful analysis of what has been the market trend and extract useful indications about new perspectives.

Complete results of the analysis are then published in the Weekly Bulletin or newsletter of Cryptocurrency… Read more

Tether Trend

The desirable trend of Tether is that there is no trend, as the currency remains stable around the price of 1 USD, because this is its function, which guarantees stability and interchangeability with the dollar. For the moment, the Tether project is … Read more

Ethereum Trend

The tendency or Ethereum trend is extremely important and significant since it is the second Cryptocurrency by market capitalization and because Ethereum has opened a path for experimentation and diversification of the Blockchain, which has subsequen… Read more

Cryptocurrency wallets

A cryptocurrency wallet is the great technological innovation that has accompanied the emergence in the market of the first cryptocurrency, Bitcoin, and that perhaps, due to the importance of Bitcoin, in the eyes of the public opinion has always been… Read more

Bitcoin Trend

The trend of an asset or value means the projection of future results of the quotes based on previous results. Practically, we want to make future predictions based on past results, because it is widely practiced in this type of simulations. Professi… Read more

Why should cryptocurrencies be used?

Why should cryptocurrencies be used?

The reasons are many, but they are not trivial. The first reason is certainly so-called disintermediation: those who possess cryptocurrencies in a proprietary wallet, and therefore not in an exchange, can use the… Read more

How to sell BTC and receive cash?

In some aspects, bitcoins are similar to cash: they are good for the bearer (identified by their private key), they are exchanged directly without intermediaries and without any limit or control.

Of course, BTC transactions are publicly recorded in … Read more

Ethereum (ETH) Stable

To date, Ethereum capitalizes more than $23 billion, ranking second after Bitcoin, even if Ripple has been chasing its place of honor for a couple of weeks now.

ETH (USD 225), like the entire cryptocurrency sector, showed a slight increase in the la… Read more

In the near future, we will no longer use passwords but wallets

One thing that few people knows is that asymmetric cryptography, which is the basis of Cryptocurrencies purses, basically serves to digitally sign transactions, so that they can only be authorized by the owner of the purse.

Another thing that few kn… Read more

What is URunlt (URUN)?

URunIt aims to create a unique platform of sports betting and games that will be managed by its community. You will host all the games within the platform and check it out with the help of the URunIt platform, users will be an active part of it. In a… Read more

A new hard fork is approaching from Ethereum

The next hard bifurcation of Ethereum is called Constantinople. A date has not yet been fixed but developers are already creating and testing the code.There is a hypothesis that could be launched by the second week of October, however, in within talk… Read more

How does the Ripple network operate?

This virtual currency has been in circulation since 2013 and its protocol was created by OpenCoin, founded by Chris Larsen and Jed McCaleb.Like Bitcoin, Ripple operates on a decentralized platform and an open-source network, which means developers ha… Read more

The Bitcoin bubble is not like Dot-com

All Remember the dot-com bubble (in Italy, were bought Tiscali, Opengate, Finmatica, E. Biscom, Fastweb, Blu, Freedomland, etc.).What you see here is the Nasdaq Composite chart between 1994 and 2005. The 2000 peak is commonly known as the … Read more

Duplicate in number of Cryptocurrency users

On November 6, 2017, according to present estimates, about 25 million people in the world possessed Cryptocurrencies. At that moment, BTC worth about 7,400 dollars and the speculative bubble of late November/December 2017 was about to commence, which… Read more

In Russia, they sell rubles to buy Bitcoins

In addition to the four large countries that suffers from high inflation, there is another one whose currency is not experiencing good terms: Russia.

Inflation in Russia is under control, but the problem is the devaluation of the ruble compared to o… Read more

Bitcoin Dominance at its highest point in 2018

The term “Bitcoin Dominance “means the percentage ratio between Bitcoin market capitalization and the general relationship of all Cryptocurrencies.Coinmarketcap publishes an updated chart daily, showing that Bitcoin dominance in the last … Read more

How is Ethereum price (ETH) changing?

Although the bearish phase is maintained, particularly for ETH, we will always consider this Cryptocurrency. To date, Ethereum capitalizes more than 21 billion dollars, placing itself firmly in second place after Bitcoin.

ETH reached a new minimum o… Read more

Bitcoin surpasses PayPal in terms of turnover

According to the statistics of the analyst Yassine Elmandjra of Ark Invest, the value of Bitcoin transactions volume reached 1.3 trillion dollars in 2018.Despite the persistence of the price stuck phase and the continuing disrepute campaign of tradit… Read more

Bitcoin value at the present moment is 6 times greater than the pre-bubble

For those who been following the trend of Bitcoin prices knows that within a long period of time in 2017 there was a powerful and substantial increase, defined as a true speculative bubble, and the graphic image makes it clear. It can also be observe… Read more

What is Bravo (BVO)?

Bravo is a project initiated in 2014 which has decided to revolutionize the anonymous micropayments sector thanks to its online mobile payment application. In 2015, BRAVO's Minimum Viable Product (MVP) was designed and launched at TechCrunch Disrupt … Read more

What is Wanchain 2.0 (WAN)?

Up to present moment, Bitcoin, Ethereum and all the other Cryptocurrencies have existed separately. This has prevented many Blockchain from interacting with each other, hindering the exchange of values between projects and limiting the massive applic… Read more

The Bitcoin hash rate is on the rise

Recent data compiled by the network shows that Bitcoin mining activity has increased. So, despite the fall in Bitcoin prices witnessed for months, it seems like miners can still profit from this activity.Even if BTC price has been dropping by 2018 af… Read more

Which countries are planning to launch Cryptocurrencies with government support?

Cryptocurrency have as one of their most recognizable elements their decentralization, i.e. they are not emitted nor controlled by a central bank; However, in recent times more and more countries have opted to launch their own Cryptocurrency, managed… Read more

Where to buy airline tickets with Bitcoins?

Cryptocurrencies are increasingly impacting the global economy. To date, its employment has spread so much that the same serves to pay the payroll of a football club to buy a plane ticket. Airlines and travel agencies have understood all the … Read more

What is Cardano (ADA)?

It’s an intelligent contract platform similar to Ethereum, with special security measures through a layered architecture. It is the first Blockchain project created by scientific philosophy and based on peer-reviewed academic research.The team … Read more

The great devaluation of the Rial pushes Iranians to buy Bitcoin

On Monday the Iranian Rial marked a new minimum against the dollar, quoting in 44230 Rials per dollar. However, in the last few hours, it had a sudden recovery of 4.8% (42105 Rials per dollar). The tug-of-war between the U.S. and Iran is at a tipping… Read more

Ethereum plummets and Bitcoin also loses value

The Cryptocurrencies, Ethereum and Bitcoin, have gone through complicated times in the last days, as both lost value, especially the Ethereum that fell to its minimum in eleven months, below 300 dollars; Meanwhile, the Bitcoin descended from the US $… Read more

Doubts about anchorage between Sovereign Bolivar and Petro have increased

The decision of the Venezuelan government, presided by Nicolás Maduro, to eliminate 5 zeros of the Bolivar Fuerte and the entry into force of the currency called Bolivar Sovereign, anchored to the Cryptocurrency Petro, has been seen by some as… Read more

What is BitTorrent?

Created in 2001, BitTorrent protocol is a communication and file sharing protocol based on a peer-to-peer network.

It is the first completely decentralized internet protocol that has succeeded in obtaining a global application on a large scale, and … Read more

China and Bitcoin

The idea of permitting the entrance of great finances into the Cryptocurrencies sector have become more and more pronounced lately, whereas important factors related to the present market are being ignored and that perhaps could create an alarm (nois… Read more

Disproportionate growth of Syscoin's price under investigation

Syscoin is investigating in the Blockchain the unmeasured and sudden growth of 245% in the value of its Cryptocurrencies, after the purchase of 1 SYS by 96 Bitcoins, in Binance, which means it was acquired by more than 627,000 dollars, according to t… Read more

Venezuela is a Latin American country with the greatest Cryptocurrency-transactions

Venezuela has emerged as the Latin American country where more Cryptocurrency-transactions are carried out, ahead of Colombia and even above the transactions carried out in a combined way in Cryptocurrency, Argentina, Peru and Ecuador. Among the diff… Read more

What are Bitcoin ETFs?

According to the news on the possible approval of the Bitcoin ETFs, there has been great anticipation in the Cryptocurrency investors’ community. With great enthusiasm, a verdict is expected that the Safety and Exchange Commission (SEC) will gi… Read more

What is nOS (NEO)?

It stands for (NEO operating system). Basically, the initiative is to build the operating system and gateway for the NEO Blockchain. The main goal of the project is to provide users with full control over their confidential data sharing online. In fa… Read more

Nasdaq soon to launch its exchange

According to several rumors, for some time now, Nasdaq had been working on its own Cryptocurrency exchange. Presently, there is an official confirmation, it is not even an exchange, but a Cryptocurrency exchange platform built with the matching techn… Read more

Malta approves historical law for recognizing blockchains

The approval of the law for recognizing blockchains is a historical step, not just for Malta but also for the European Union. The first legal framework completed for the blockchain technology was conceived on this Mediterranean island. Now that the R… Read more

Europe will officially recognize digital currencies

In some twenty odd days, the EU will officially recognize virtual currencies, when the regulation EU 2018/843 of the European Parliament and Council, published in the Official Gazette of the European Union L. 156 06/19/2018 will, in fact, go into eff… Read more

Europe is divided over regulating cryptocurrencies

Cryptocurrencies are keeping Europe divided since, whereas various countries are more open toward cryptocurrencies, others prefer regulating a technology that is, per se, decentralized.In France, the well-known economist Jean Pierre Landau, in collab… Read more

Ethereum vs. Bitcoin, which is the best Cryptocurrency?

The Bitcoin and Ethereum can be considered as the two most commonly used Cryptocurrencies nowadays, they are compatible but not substitute. Both have similarities, for example, they are decentralized, that is, there is no entity that controls the cur… Read more

Is Petro a Cryptocurrency?

Petro is one of the initiatives implemented by the Venezuelan Government led by President Nicolas Maduro, to try and obtain funds, which can overcome the tough economic crisis that crosses the South American country, plunged in a round of inflation t… Read more

The Ubank mobile app with Ubcoin will be pre-installed on LG smartphones

The Ubank mobile payment application will be pre-installed on LG Electronics smartphones after being pre-installed on Samsung phones in 10 countries. Thus, LG phone users will also have access to Ubcoin, the EBay-style Marketplace based on blockchain… Read more

What is Bitcoineta?

Bitcoineta looks like a pickup truck with the difference of being covered in Bitcoin advertising and brings a message, an idea, to communicate, connect people, make known and demonstrate the properties that have decentralized technologies, and on the… Read more

What is Komodo (KMD)?

It’s a decentralized Cryptocurrency based on the open source Blockchain, was launched in September 2016. The platform generated from a bifurcation of Zcash, a Cryptocurrency that allows users to remain anonymous while performing transactions.Th… Read more

What is Togacoin (TGA)?

This project consists of a team of professionals who have worked for more than 20 years in the IT and data center sectors, active in the European territory with diverse proven and successful experiences in digital technologies and data centers, They … Read more

More than 1.000 Cryptocurrencies have already died

According to data from two platforms, Coinopsy and DeadCoins have already killed more than 1,000 Cryptocurrencies.Coinopsy provides daily reviews of several Cryptocurrencies, including those considered "dead". According to this site, a token is dead … Read more

What is AELF (ELF)?

Aelf is a specific customizable operating system (OS) for blockchain. The team aims to make this project become the “Linux system “of the blockchain community. To resolve the current problems with blockchain technology, Aelf focuses on tw… Read more

How to invest in gold and pay with cryptocurrencies?

Investing in gold is one of the safest existing operations, because it is exempted from the huge fluctuations of international exchanges, the swings of major currencies and the changes in oil prices that are almost always related to political scenari… Read more

Glossary of cryptocurrencies and blockchain technology

Blockchain revolution has introduced innovative practices in today's world, especially those relating to cryptocurrencies. As in most of the technology, terminology of cryptocurrencies and blockchain are in full development, that is, are continually … Read more

How to take advantage of market instability

Market instability is one of the most worrisome themes for cryptocurrency investors. How can I predict what is going to happen in the markets? Where can I find useful information and which can I discard as useless? How can I keep a profitable portfol… Read more

What is FidelityHouse (FIH)?

FidelityHouse is an ICO and Italian social network with an already interesting number: 20 million monthly unique users and 100 million views per month.However, the most correct definition would be "interest network” because it is not a generic … Read more

Is the Bitcoin dead?

How many times has the Bitcoin been given up for dead? At all-time there are always growing oscillations that generates a variation to the general average, gurus, bankers, false politicians and enemies of the cryptocurrencies, that sentence the death… Read more

How to obtain a license for Cryptocurrencies trading in Estonia?

Estonia is a country that promotes cryptocurrencies business and its legislation is friendly to any foreign investor, regardless of their nationality, who seeks to register their companies in that Baltic country. To facilitate this process, the Eston… Read more

Cryptocurrencies and e-wallets vs. coins and banks, who will win the battle?

Cryptocurrencies have taken on a big boom. Bitcoin is on the rise and even the Venezuelan government of Nicolás Maduro has bet on a Cryptocurrency, the Petro. This growth in the economy of Cryptocurrencies worries tax collectors, especially of… Read more

CryptoHawk launches multiple solutions for Cryptocurrencies

Fabrizio Zampieri, Economist and financial analyst expert in Cryptocurrencies and blockchain, has been appointed advisor at CryptoHawk AG, a Swiss Company, active in the all-in-one solutions sector in the Cryptocurrencies world.The company is ready t… Read more

Litecoin among the first 6 cryptocurrencies

Among the Cryptocurrencies Litecoin is spreading more and more, the least famous "prime" to Bitcoin. The birth of this Cryptocurrency, based, on a technical view point, in the Bitcoin model, is attributed to Charlie Lee (a former Google employee) who… Read more

Buying Cryptos with Prepaid Card

Exchanging Visa or MasterCards gift cards to cryptocurrencies could seem difficult at first, but there is no need to worry because this article will offer you solutions that will help you exchange your prepaid cards to cryptocurrencies.

What are Pre… Read more

Where and how can I buy Tether?

Tether is a Cryptocurrency that represents real tokens in a Blockchain market. It currently has two tokens, USDT and EURT, analogous to the USD and EUR. This Cryptocurrency allows to save money and make transactions worldwide in a simple way. Experts… Read more

What is Tripago travel (TGP)?

Tripago Travel is a newly created company that has planned the launching of an online decentralized travel platform built on Ethereum’s network. The company's mission is to solve the travel needs of its customers through the same platform.If yo… Read more

What is Tether?

Tether is a Cryptocurrency, based on blockchain technology, which was created to have a virtual equivalence with the U.S. dollar, so its price will always be the same and this has influenced what many call "crypto-dollar". Tether … Read more

What is Ethereum?

Ethereum is second Cryptocurrency in terms of market capitalization after Bitcoin. In most cases Bitcoin and Ethereum are cited as examples of Cryptocurrencies whereas the truth is that, although they have some similar characteristics, they are two d… Read more

How do Cryptocurrencies impact the real estate market?

Real estate market has also been favored by the great advantages of the blockchain and the Cryptocurrencies so much that Cryptocurrency 10 has decided to accept real estate transactions in its new Cryptocurrency exchange platform that will soon be la… Read more

The volatility of Bitcoin's price is lower

There is a specialized site that measures the volatility of the Bitcoin price with estimates from the last 30 to 60 days, www.buybitcoinworldwide.com/volatility-index.Volatility is calculated as the price variability in the time period considered: Th… Read more

EToro and the Copyfund, an interesting investment strategy

EToro is a world-leading social trading network, which uses the innovative CopyTrader function that enables the copying of successful and experienced traders investment strategies.

In addition, EToro has CopyFunds, a thematically managed and long-te… Read more

Bankera acquires Pacific private bank in Vanuatu

Bankera, which was considered one of the most successful in 2017 in the initial currency offer (ICO), recently acquired the Pacific Private Bank of Vanuatu, an institution with more than 20 years of experience in the industry.The bank's purchase will… Read more

EOS launches its own blockchain

The EOS blockchain is officially active: it was the community itself that decided the time and date of the launch, thanks to a vote held 4 days ago directly on YouTube.At the time, EOS is the fifth most important cryptocurrency in the world, with a m… Read more

Why Should I keep Ethereum (ETH)?

Until otherwise specified, we’ll always keep this cryptocurrency in our wallet. Up to now, Ethereum has capitalized 50 billion USD, landing solidly in second place after Bitcoin.

Despite the strong dip in prices of the entire sector of the c… Read more

What offers ICO Mingo?

The ICO of the Mexican application Mingo was presented during the Summit Tech Dublin held a week ago.Mingo is the first major project of Cryptocurrencies fully developed in Ireland. The platform developed a messaging application that transmits messag… Read more

What is Reddcoin (RDD)?

In a world where social networks are becoming the main information, entertainment and participation channels, we can talk of Reddcoin which is a Cryptocurrency that allows payments within the most important social networks. The social currency that p… Read more

What is Opiria?

The objective of the Opiria team (with headquarters located in Ingolstadt, Germany) is to realize the first market based on the Ethereum blockchain for the purchase and sale of personal data in a safe and transparent mode. The platform allows… Read more

What is ICON (ICX)?

ICON is considered as the Korean Ethereum, but, unlike ETH, its network was launched only in January 2018. The founders had to establish their project in a country that have decided to regulate the Cryptocurrencies (unlike others, like China, which, … Read more

EOS enters the top 5 Cryptocurrencies by market capitalization

EOS has exceeded $12 billion dollars in capitalization. Litecoin, Stellar and Cardano, on the other hand, are slightly above 8 and 9 billion; Therefore, we can say that EOS seems to have overcome firmly to Litecoin, considered one of the most famous … Read more

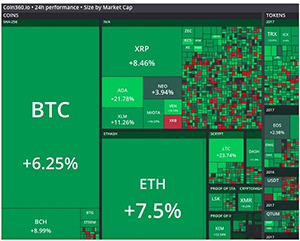

What is Coin360.io?

This is an online platform where you can have the latest data on Crytocurrencies market situation, which include (among others) the indication of the current market capitalization of all major currencies and tokens. This service was launched in 2017 … Read more

Thailand opens its way for tokens marketing

Thailand seems to be opening a new path to selling tokens, as the first initial coin offer (ICO) by a company on the Asian Stock Exchange began to be quoted in two local markets. However, the financial regulators of that nation continue to work on cr… Read more

Cryptography is the true revolution and not the blockchain

Many people argue that Cryptocurrencies are not really such a revolutionary innovation, as is the blockchain whereas in the stock exchange market they are investing in blockchain development companies.Others, on the contrary, argue that only the bloc… Read more

10 reasons to invest in Cryptocurrencies

We all know that Crytocurrencies have had a revolutionary impact on the world economy. The fact that they are not controlled by any government or bank, not affected by the inflation of a certain country, that allows us to work under some anonymity on… Read more

What is Loopring (LRC)?

Loopring is a protocol that consists of a decentralized exchange of tokens Exc20 in the Ethereum blockchain. Loopring permits multi-token transactions, offering many advantages to its users like exchanges to integrating decentralized intelligent cont… Read more

The first futures of Ethereum and the BGCI index are launched

On May 11, at 4:00 p.m. (Greenwich Time), the first futures were quoted on the Crypto Facilities platform, a cryptocurrencies trading business headquartered in the United Kingdom. First of all, futures are standardized contracts, since the stock mark… Read more

Payment System with Facial Recognition

Alibabacoin Foundation has developed a new technology that combines a payment system based on the blockchain system with facial recognition, this way, instead of the usual username and password to make payments, the facial recognition (which is integ… Read more

Taklimakan an ICO for blockchain enthusiasts

It’s a bit like an information portal for blockchain enthusiasts, stock exchange agents and market analysts, from beginners to experts. The founders finished announcing that they had reached a soft cap of 5 million dollars for their ICO, just a… Read more

Which Jurisdictions prefer Exchange platforms?

Malta is currently the country with the greatest trade volume for cryptocurrencies in the world. The news was reported on April 29 by Business Insider, quoting a recent investigation conducted by the banking institution, Morgan Stanley. A group of in… Read more

What is NEM (XEM)?

It’s one of the most interesting cryptocurrency alternatives to Bitcoin in circulation at present, thanks to a very ambitious and different project compared to Bitcoin. The cryptocurrency NEM, abbreviation of “New Economy Movement” … Read more

What is Webcoin?

The pre-sale of Webcoin has begun. The commercial procedures will take place on the Webhits.io platform and will be managed by the Webcoin team. The Webhits.io platform allows traffic to “switch” to websites. To work, it will use a new to… Read more

What is a blockchain? And why it’s important

The Blockchain is the software invented by Satoshi Nakamoto for the decentralized distribution of Bitcoin. Bitcoin and Blockchain are often used as synonyms, but actually, Blockchain is an open software that was absolutely innovative for that period … Read more

How to start an ICO?

Making an ICO (Initial Coin Offering) is not something easily done. You need a lot of money to initiate an ICO: for marketing, development and management. Many offer tokens for consultations, programming and services necessary for starting up. Seriou… Read more

How to obtain free Bitcoin from the forks

You may have earned Bitcoins without having done anything. How? Simple, if you have Bitcoins in a cold wallet (or, in any case, in a portfolio whose private keys you control and therefore not a wallet in professional Exchange) and you haven’t m… Read more

How to learn the basics of Cryptocurrencies?

Nowadays, it’s becoming more and more important understanding the complex world of Cryptocurrencies. This is because of the key role played by the Bitcoin, Ethereum and others in the global economy. Where can I find reliable information… Read more

Conversation with BKX holder Fabrizio Zampieri

Italian economist and financial adviser Fabrizio Zampieri discusses blockchain’s potential impact on the financial industry and what to watch out for when dealing with cryptocurrencies. Fabrizio Zampieri has a degree in Business Administration … Read more

The gurus of the financial world already trust cryptocurrencies

At present, economists, politicians and big investors can’t ignore the importance acquired by cryptocurrencies, especially Bitcoin, in global finances. Not just a few of these gurus were initially worried and even harshly criticized digital cur… Read more

Five odd things that can happen in the Bitcoin blockchain

In 2009, Bitcoin became the world’s first cryptocurrency and, currently, at almost a decade from its creation, it has been strengthened at most used cryptocurrency on the market and since it has managed to survive its first big crisis, followin… Read more

What type of wallet should I choose for my cryptocurrencies?

Cryptocurrency portfolios contain two keys, one public and the other private, which allow mobilization of the funds. There are all kinds of portfolios; some are simple, while others are more complex and inappropriate for beginners.

The most common t… Read more

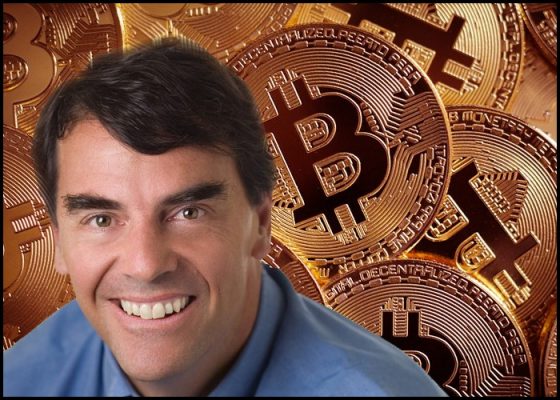

Bitcoin, the best place to put your money, according to Tom Draper

For the private equity investor, Tim Draper, founder of the Draper, Fisher and Jurvetson company, the Bitcoin is the “most secure place to put your money”, because this is a more secure, decentralized, useful and global currency that can… Read more

What is Tron?

Tron is a cryptocurrency that works with blockchains which proposes building a platform dedicated to the entertainment industry. Tron has its headquarters in Singapore and is directed by the very young – not even thirty-three years old – … Read more

What is Litecoin?

Litecoin is a point to point cryptocurrency that works on a blockchain platform which was created to act as a payment system with a very much reduced commission fee.Litecoin was begun by Charlie Lee in 2011, during the period when he worked for Googl… Read more

What can we do with cryptocurrencies?

Theoretically, there are no limits, although in practice, the uses aren’t as ample as hoped. The potential is enormous; however, referring to cryptocurrencies today, experts speak more about where they can arrive than what they really are.Bitco… Read more

Can cryptocurrencies mark the end of real money?

Cryptocurrencies could mark the end of “real money”, although this moment hasn’t arrived yet. Many say that cryptocurrencies are an invention, without either support or backing, but these days, what support or backing do “real… Read more

What is Ripple?

Ripple is a cryptocurrency established in 2012, since has maintained a very stable quotation from that time until March 2017 when the price started at USD 0.04 until it reached a maximum price of USD 2.40.Ripple is building an innovative platform bas… Read more

What is Bitcoin Cash?

Bitcoin Cash, which was the result of the first Bitcoin hard fork in August 2017, will now be a hard fork for bringing the block’s size from the current 8MB to 32 MB. This new update of Bitcoin Cash speaks volumes about the ambitions that the m… Read more

What is a wallet?

The electronic or e-wallet is a place where cryptocurrencies can be deposited. There are wallets that are compatible with a single currency and others where multiple currencies can be deposited. In practice, a wallet is a software that serves for con… Read more