Table of Contents

Caporaso & Partners files a formal FBI complaint against Blockchain.com, alleging Bitcoin theft and spotlighting critical issues of accountability in the crypto market

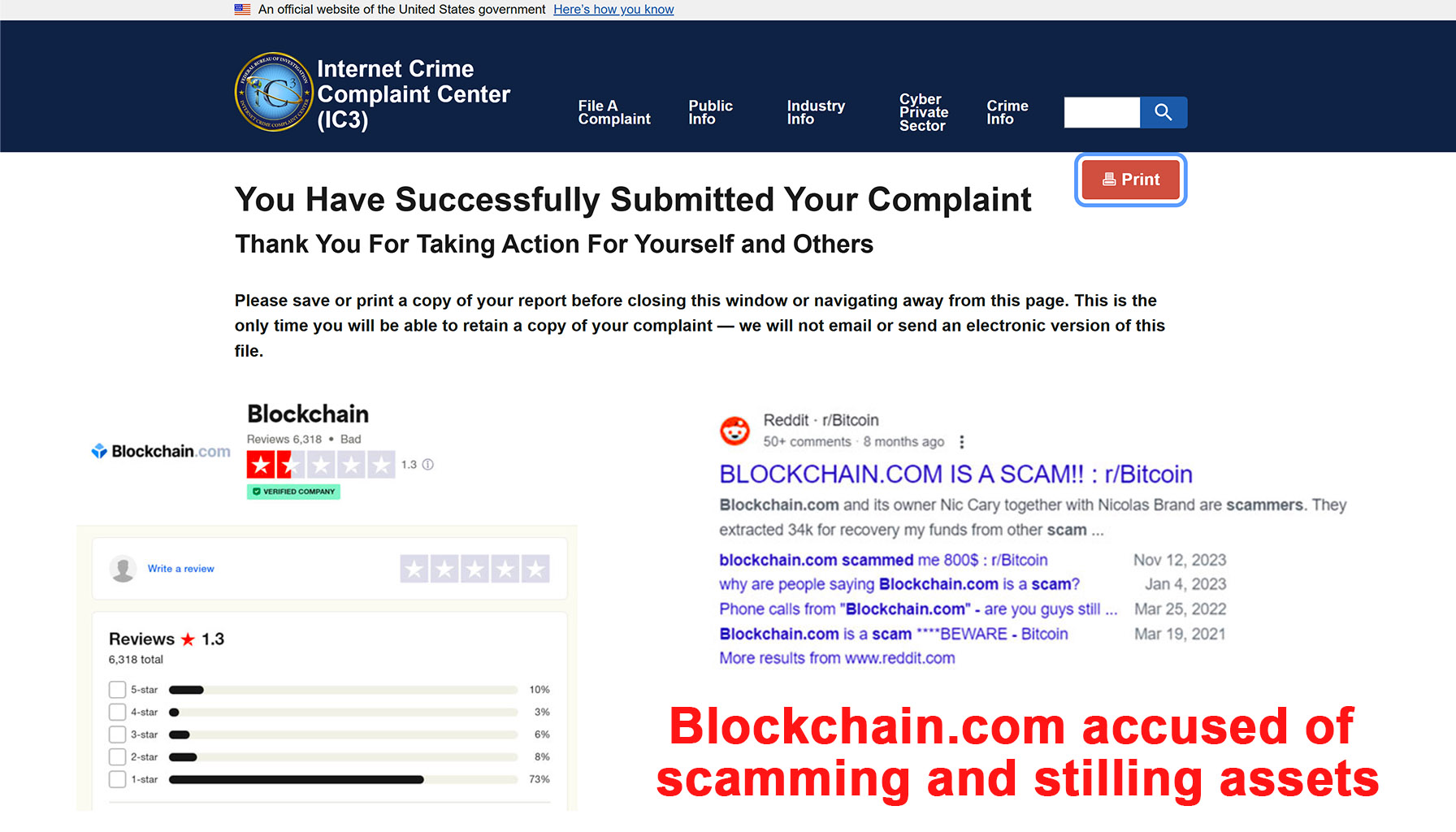

In a move that underscores growing concerns over accountability in the cryptocurrency sector, Caporaso & Partners Law Office has filed a formal complaint with the FBI against Blockchain.com, alleging the theft of a significant amount of Bitcoin (BTC) from a client’s digital wallet. The formal complaint has been filed with the Federal Bureau of Investigation (FBI) in the United States and simultaneously submitted to regulatory authorities in Lithuania (Financial Crime Investigation Service under the Ministry of the Interior), Singapore (Monetary Authority of Singapore, MAS), the United States (Office of Financial Regulation in Florida), the Cayman Islands (Cayman Islands Monetary Authority), and Italy (Organismo Agenti e Mediatori, OAM).

This legal move highlights ongoing concerns about accountability and transparency within the cryptocurrency industry, particularly involving platforms like Blockchain.com, which operates without adequate oversight in certain jurisdictions.

Unregulated Actions and Abusive Practices by Blockchain.com

The allegations against Blockchain.com stem from the platform’s handling of unregulated decentralized finance (DeFi) wallets. According to Caporaso & Partners, Blockchain.com recently engaged in a series of abusive actions by unilaterally transferring clients’ crypto assets to a DeFi wallet without prior notification or user consent. Once these assets were moved, users encountered significant barriers to accessing them. Attempts to transfer funds out of the DeFi wallet triggered a persistent “Error 400,” rendering the assets effectively frozen.

Efforts to resolve these issues through Blockchain.com’s support channels proved futile. The legal team representing affected users describes the company’s customer support responses as generic and evasive, offering no viable solutions. Furthermore, neither Blockchain.com’s legal nor public relations departments have responded to inquiries, leaving clients in a state of uncertainty and frustration.

Blockchain.com is one of the most prominent cryptocurrency platforms, offering services such as digital wallets, cryptocurrency trading, and blockchain data analytics. Founded in 2011, the platform has positioned itself as a leader in the crypto space, claiming to serve millions of users worldwide. Despite its widespread adoption, Blockchain.com operates under a decentralized model, with limited direct oversight in various jurisdictions. The company’s executive leadership, headed by CEO Peter Smith, has faced criticism for its handling of user funds, transparency issues, and regulatory compliance. These concerns have been amplified by recent allegations of misconduct and unresolved complaints from its global user base.

Adding to these grievances is the eventual disappearance of the frozen assets. Blockchain.com attributes these losses to supposed user security failures, a claim vehemently disputed by Caporaso & Partners. “This is not merely negligence,” said a representative of the law office. “It is an orchestrated abuse of trust that exploits regulatory gaps and undermines the fundamental principles of financial fairness.”

Caporaso & Partners Law Office is a premier legal firm based in the Republic of Panama specializing in financial and cryptocurrency law. With extensive experience in navigating complex financial disputes and regulatory challenges, the firm is dedicated to protecting the rights and interests of its clients. Caporaso & Partners offers expert legal counsel, representation, and advocacy in matters related to financial misconduct, regulatory compliance, and cryptocurrency-related disputes.

A Legal Void Fostering Impunity

Caporaso & Partners’ complaint underscores the structural issues enabling such incidents to occur. Blockchain.com’s operations reveal a troubling exploitation of jurisdictional gaps. The platform operates with regulatory licenses in several U.S. states, including Alabama, Alaska, Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Georgia, New Hampshire, North Dakota, Ohio, South Dakota, Vermont, and Washington. These regulatory frameworks focus solely on protecting residents within their respective states, neglecting the plight of users affected outside their jurisdictions. This narrow scope creates a legal limbo, allowing platforms like Blockchain.com to exploit these gaps with little accountability to victims from other regions.

The law office’s investigation further highlights systemic inaction among regulatory bodies. Despite being informed of these issues, authorities in various jurisdictions have failed to launch comprehensive investigations. “Regulators are washing their hands of responsibility,” Caporaso & Partners stated, adding that the current oversight frameworks inadvertently foster an environment of impunity where fraudulent activities by platforms like Blockchain.com can thrive unchecked.

A cursory online search amplifies these concerns. Numerous complaints from users claiming to have been defrauded by Blockchain.com are visible on platforms like Reddit. On Trustpilot, the company’s reputation stands at a dismal 1 out of 5 stars, underscoring widespread dissatisfaction and mistrust among its user base.

Call for Immediate Action against Blockchain.com

Caporaso & Partners Law Office is urging regulatory bodies and law enforcement agencies to prioritize this case and address the broader implications for consumer protection within the cryptocurrency sector. “This is a wake-up call for regulators globally,” the firm declared. “The lack of accountability in the cryptocurrency market jeopardizes not only individual investors but the integrity of the financial system as a whole.”

In filing the FBI complaint and reaching out to international regulatory authorities, Caporaso & Partners aims to shed light on Blockchain.com’s misconduct and advocate for stronger protections against similar abuses in the future. The law office also calls on other victims to come forward and share their experiences, emphasizing the importance of collective action in holding bad actors accountable.

For further information or to report related incidents, please contact Caporaso & Partners Law Office directly. Their legal team remains committed to pursuing justice for those affected and to pushing for systemic reforms in the cryptocurrency industry.

Challenges and Legal Complexities in Disputes Across Multiple Jurisdictions

Caporaso & Partners emphasize that a strategic approach is indispensable when addressing such disputes. Their expertise in cross-border financial litigation highlights the importance of understanding international regulatory frameworks and leveraging agreements to navigate these challenges effectively. Clients are advised to collaborate with professionals adept in dissecting the operational and legal intricacies of multinational financial entities. Building a robust case hinges on meticulous documentation and a comprehensive grasp of the institution’s global regulatory obligations, ensuring a focused and informed pursuit of justice.

When financial institutions like Blockchain.com operate under multiple licenses across various countries, the complexity of legal disputes escalates dramatically. The core issue often lies in navigating diverse regulatory landscapes and determining which jurisdiction should preside over the matter. Countries maintain distinct financial laws, consumer protections, and procedural nuances, creating inevitable conflicts and inconsistencies in cross-border cases. This jurisdictional puzzle can be both contentious and protracted, especially when the same practice is deemed lawful in one country but prohibited in another. Compliance with varying standards can further entangle matters, as institutions may unintentionally—or strategically—adopt practices that create operational discrepancies. For instance, Blockchain.com’s global operations exemplify the challenges of aligning varied regulatory mandates while maintaining coherence across jurisdictions.

Enforcing legal decisions across borders adds yet another layer of difficulty. Even when a judgment is secured in one country, its applicability elsewhere is not guaranteed, particularly if assets are concealed within intricate corporate structures. These structures, often compartmentalizing liabilities, make pinpointing accountability exceedingly arduous. Moreover, dealing with multiple regulatory bodies, each with unique priorities and procedures, introduces further delays and disputes over authority. Financial entities with global reach sometimes exploit such gaps through tactics like forum shopping, seeking jurisdictions that offer favorable conditions, which complicates efforts to hold them accountable.

How to Address Account Blocks and Stolen Assets on Blockchain.com and Other Financial Platforms

If your account with a financial institution has been blocked, it’s essential to take specific steps to address the issue and regain access promptly. Start by identifying the reason for the block—this could range from suspicious activity or irregularities, missing or outdated documents, repeated login errors, or security measures triggered by unusual transactions. Review any notifications from the institution carefully, as they may outline the exact cause and the steps required to resolve it. In some cases, resetting your password or updating your personal information may suffice. However, if the block involves legal or compliance issues, the process may take longer and require submitting additional documentation. To prevent future account blocks, ensure your information is always up to date, use strong and regularly updated passwords, and notify the institution in advance of unusual activity like international transactions or significant withdrawals. If you believe the block is unwarranted or the issue is not being resolved adequately, seeking legal advice is a practical and often affordable solution. A quick consultation with an expert can provide clarity on your options and save you time and money in the long run. Staying proactive, cooperative, and organized is key to efficiently resolving account-related issues with a financial institution.

Additionally, keep in mind that account blocks are often a security measure designed to protect clients and financial institutions from fraud or unauthorized access. While it can feel frustrating, such actions are in place to safeguard your funds and personal information. However, in cases where assets have been stolen—such as situations involving digital platforms like Blockchain.com—it is crucial to act immediately. Contacting specialized lawyers, such as Caporaso & Partners, can make a critical difference in recovering stolen funds. Their expertise in financial and fintech-related disputes ensures that your case is handled efficiently and with the necessary legal precision. Time is of the essence in these situations, as delays may significantly reduce the chances of asset recovery. By working with experts, you can better protect your interests and navigate complex cases with confidence.

Risk warnings

The views and opinions expressed are the views of Crypto Currency 10 and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material(s) have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Changes in rates of exchange may have an adverse effect on the value, price or income of an investment.

Past performance is no guarantee of future results and the value of such investments and their strategies may fall as well as rise.